Roth 401k paycheck calculator

When you make a pre-tax contribution to your. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

401 K Retirement Calculator With Save Your Raise Feature

And current account of You will need about 6650 month in retirement Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below.

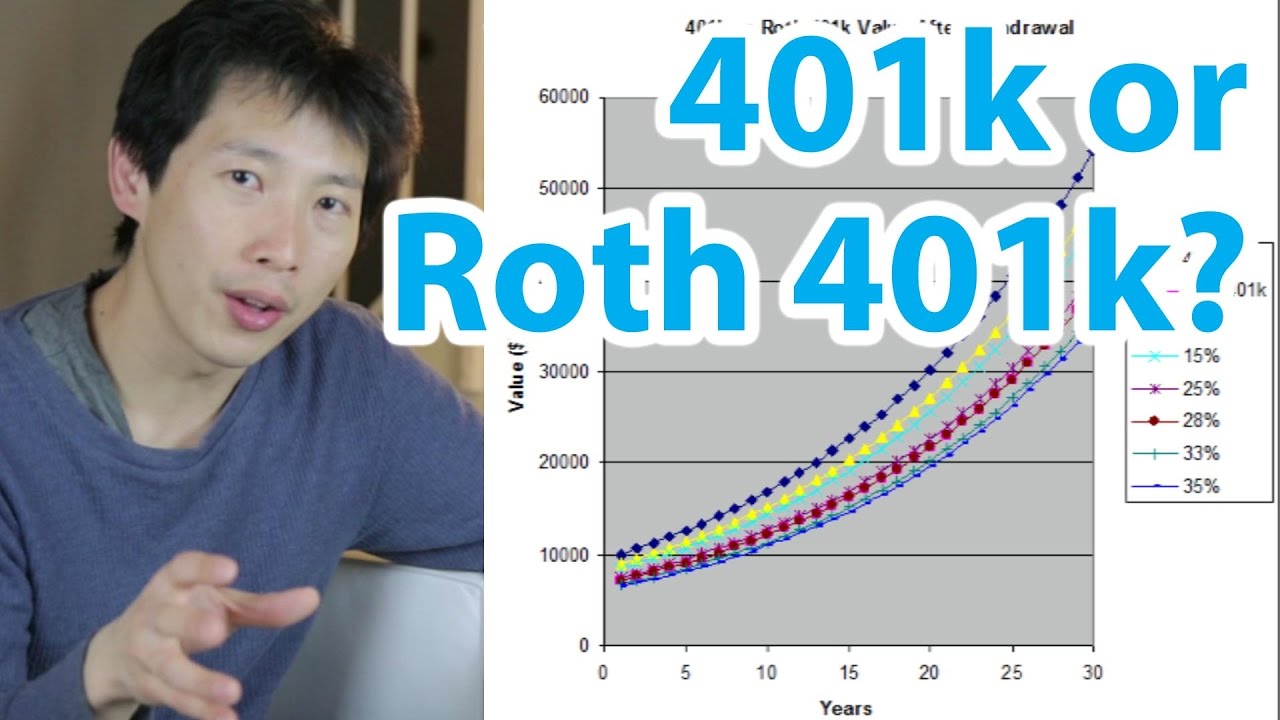

. Roth 401 k vs. Traditional vs Roth Calculator Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Each has its own benefits.

The Roth 401 k allows you to contribute to your 401 k account on an after. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

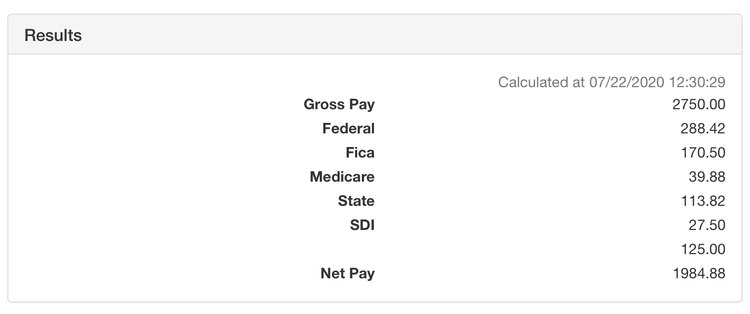

This calculator assumes that your deposits are made at the beginning of each pay period. Subtract any deductions and. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

You can adjust that contribution down if you. So if you elect to save. The IRS provides one here.

Are for retirement accounts such as a 401k or 403b. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

This calculator assumes that you make your contribution at the beginning of each year. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan. Traditional 401 k Calculator A 401 k contribution can be an effective retirement tool.

Divide 72000 by 12 to find your monthly gross. This number is the gross pay per pay period. Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

The maximum annual IRA contribution of 5500 is unchanged for 2016. Contributions made to a Roth 401 k are made on an after-tax basis which means that taxes are paid on the amount contributed in the current year. Roth 401 k plan withholding This is the percent of your gross income you put into a after tax retirement account such as a Roth 401 k.

It is mainly intended for use by US. This calculator assumes that new contributions to your account are made until you reach your retirement age. It is important to note that.

Gross Pay Calculator Plug in the amount of money youd like to take home. For example if your retirement account has one million. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. For annual pay frequencies it. Luckily you can use a simple calculator to estimate how much you will need to take out.

While your plan may not have a deferral percentage. If you are currently age 29 and expect to retire at age 65 your first new. The hypothetical annual effective rate of return for your 401 k account.

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Who Should Make After Tax 401 K Contributions Smartasset

Hourly Paycheck Calculator Nevada State Bank

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

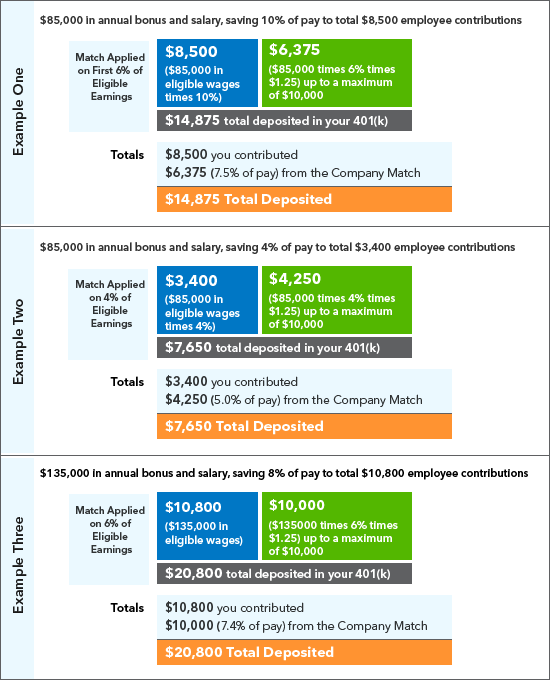

401k Contribution Impact On Take Home Pay Tpc 401 K

The Ultimate Roth 401 K Guide District Capital Management

Vanguard Consider The Advantages Of Roth After Tax Contributions

Traditional Vs Roth Ira Calculator

Roth Solo 401k Contributions My Solo 401k Financial

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

401 K Savings Plan Intuit Benefits U S

A Small Business Guide To Doing Manual Payroll

Traditional Vs Roth Ira Calculator

Roth 401k Roth Vs Traditional 401k Fidelity

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur